MORE…

Gold price by GoldBroker.com

About GOLD PRICES.

The Factors Influencing Gold Prices: Understanding the Dynamics

Gold has been a valuable commodity for centuries, serving as a store of value, a medium of exchange, and a hedge against economic uncertainty. Understanding the factors that influence gold prices is crucial for investors, economists, and policymakers. This article explores the dynamics that drive gold prices, the benefits of investing in gold, and the future outlook for gold markets.

Historical Significance of Gold

Gold has held a unique position in human history. From ancient civilizations to modern economies, gold has been revered for its rarity, durability, and beauty. Its historical significance as a form of currency and a symbol of wealth continues to influence its value in today's markets.

Key Factors Influencing Gold Prices

Supply and Demand

The fundamental principle of supply and demand plays a significant role in determining gold prices. Limited supply and increasing demand, especially from emerging markets and central banks, can drive prices higher.

Inflation and Deflation

Gold is often seen as a hedge against inflation. When inflation rates rise, the purchasing power of fiat currencies declines, making gold an attractive investment. Conversely, during periods of deflation, gold prices can also rise as a safe-haven asset.

Interest RatesThere is an inverse relationship between gold prices and interest rates. When interest rates are low, the opportunity cost of holding gold decreases, leading to higher demand and prices. Conversely, higher interest rates make other investments more attractive, potentially lowering gold prices.

Geopolitical Stability

Political and economic instability can drive investors to seek safety in gold. Events such as wars, political turmoil, and economic crises often lead to increased demand for gold as a secure asset.

Currency Fluctuations

Gold prices are inversely related to the value of the US dollar. When the dollar weakens, gold becomes cheaper for foreign investors, increasing demand and driving prices up. Conversely, a strong dollar can lead to lower gold prices.

Central Bank Policies

Central banks hold significant reserves of gold and can influence prices through their buying and selling activities. Policies related to gold reserves and monetary policy decisions can impact gold prices.

Global Economic Performance

The overall performance of the global economy can affect gold prices. Economic growth can lead to increased industrial demand for gold, while economic downturns can increase demand for gold as a safe-haven investment.

Benefits of Investing in Gold

Hedge Against Inflation - Gold is an effective hedge against inflation, protecting investors from the declining value of fiat currencies.

Diversification - Including gold in an investment portfolio can reduce risk and volatility, as it often moves inversely to stocks and bonds.

Safe-Haven Asset - Gold is considered a safe-haven asset, providing stability and security during times of economic and geopolitical uncertainty.

Liquidity - Gold is a highly liquid asset, easily convertible into cash in most markets around the world.

Tangible Asset - Unlike stocks or bonds, gold is a tangible asset that can be held and stored, providing a sense of security and ownership.

The Future Outlook for Gold Prices

The future outlook for gold prices depends on various factors, including economic conditions, geopolitical developments, and changes in supply and demand dynamics. As global uncertainties persist, gold is likely to remain an attractive investment option for many.

Technological Advancements - Advances in technology, particularly in the mining sector, could impact gold supply and influence prices. Improved extraction techniques and new discoveries may increase supply and affect the market.

Environmental Considerations - The environmental impact of gold mining is becoming increasingly important. Sustainable mining practices and regulations may influence the cost of production and, consequently, gold prices.

Digital and Cryptocurrencies - The rise of digital and cryptocurrencies presents both challenges and opportunities for gold. While some investors may prefer digital assets, others may continue to see gold as a more stable and reliable store of value.

Economic Policies - Future economic policies, including monetary and fiscal measures, will play a crucial role in shaping the gold market. Policies aimed at stabilizing economies or stimulating growth could impact gold demand and prices.

Conclusion

Understanding the factors that influence gold prices is essential for making informed investment decisions. From supply and demand dynamics to geopolitical stability and economic policies, various elements contribute to the price of gold. As a valuable and enduring asset, gold will continue to play a significant role in investment portfolios and the global economy.

Engineering

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

Constriction

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

Equipment

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

Eletroniex

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

Architecture

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

Isolations

Rorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt.

We Are the Go To Place

For all things GOLD PRICES

Advertise here or share your news, purchase domain, contact us to talk more…

Construction Conditio in Regions

Lorem ipsum dolor sit amet, consectetuer adipiscing elit...

Regions Construction Conditio in

Lorem ipsum dolor sit amet, consectetuer adipiscing elit...

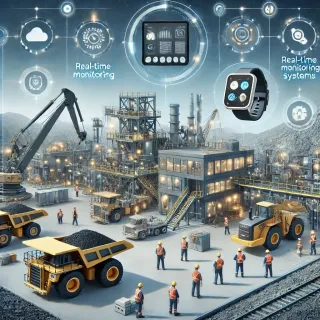

Innovations in Mining: The Role of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various industries, and mining is no exception. These advanced technologies are revolutionizing mining operations, improving eff... ...more

Mining

June 19, 2024•3 min read

The Role of Technology in Enhancing Mining Safety Standards in the USA

The mining industry has long been known for its hazardous working conditions, making safety a top priority for mining companies. In recent years, technological advancements have significantly improved... ...more

Mining

June 19, 2024•3 min read

Rare Earth Elements: How the USA is Securing its Supply Chain for High-Tech Manufacturing

Rare earth elements (REEs) are critical components in various high-tech applications, from electronics to renewable energy technologies. Securing a stable supply of these elements is vital for the USA... ...more

Mining

June 19, 2024•2 min read

Sustainable Practices in American Mining: How the Industry is Reducing Its Environmental Impact

Sustainable Practices in American Mining: How the Industry is Reducing Its Environmental Impact ...more

Mining

June 19, 2024•2 min read

The Future of Lithium Mining in the USA: Trends, Challenges, and Opportunities

Lithium, a critical component for batteries used in electric vehicles and renewable energy storage, is increasingly important in today’s technology-driven world. The USA, with its significant lithium ... ...more

Mining

June 19, 2024•2 min read

Top 10 Mining Innovations Revolutionizing the USA’s Mineral Extraction Industry

The mining industry in the USA has always been at the forefront of technological advancements. As the demand for minerals and resources continues to grow, so does the need for more efficient, safe, an... ...more

Mining

June 19, 2024•2 min read

MORE ABOUT US

We Provide Exceptional Solutions for Clients

Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Serving 20 Years

Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Financial Advices

Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

QUESTION? xxx-xxx-xxxx

OUR SKILLS Plan

We Create Buildings

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Audit & Assurance 90%

Legal Managed Services 85%

Financial Advisory 70%

Advisory Financial 60%

COMPLATE PROJECTS

Completed Your Company Projects

OUR MEMBER

Project Team Member

Rayhan Khan

Team Leder

Metton Alex

Founder

Rayhan Khan

Team Leder

820

HAPPY CLIENT

180

COMPATE PROJECT

20

WORLD FACTORY

487

CONTRACTORS

Industries Consult

Lorem ipsum dolor sit amet, consectetuer adipiscing elit aenean commodo ligula.

Bariblan

Constriction

Architecture Style

Lorem ipsum dolor sit amet, consectetuer adipiscing elit aenean commodo ligula.

Bariblan

Constriction

General Contracting

Lorem ipsum dolor sit amet, consectetuer adipiscing elit aenean commodo ligula.

Bariblan

Constriction

OUR CLIENTS

What Client Say?

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes.

Chicana males

Marketing

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes.

David Markers

Co- Of Officer

Do You Have Queries? Please Go Through 'Frequently Asked Questions' First

Lorem ipsum dolor sit adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

{question 1}

Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet.

{question 2}

Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet.

{question 3}

Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet.

{question 4}

Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet, consectetur adipis. Maec enas id nibh non. Lorem ipsum dolor sit amet.

{question 5}